The correct method used to change vehicle tax class depends on several key factors. For example, is the road tax due to run out (or not) and does it qualify for exemption? This help guide explains how to change the taxation classification of a vehicle from one paying class to a different one (e.g. from disabled to normal) and how to work out the new tax rate.

Certain kinds of vehicle alterations affect the rate of duty you need to pay. Some of the common vehicle changes that affect tax can also affect vehicle tax rates and its taxation classification.

So, you will need to change vehicle tax class with the DVLA any time you make modifications that affect the:

Note: Depending on the year of manufacture, certain types of historic (classic) vehicles are exempt from Vehicle Excise Duty (VED).

You will need to supply DVLA with a payment method to change taxation class. They may also need some extra documentation for vehicle tax change. The specific application forms needed will depend on the type of vehicle you have and several other factors.

As a rule, vehicles exempt from road tax (or paid at a lower rate) will be when they are used by (either):

Important: Making a false declaration about road tax exemption is a criminal offence which can result in a fine or imprisonment.

There are several ways to change car tax class (using different forms). The correct method for changing taxation classification will depend on whether:

Note: Check the sections below to find out when to use DVLA V70 form and when it must be the V62 tax class form at the Post Office. There are some differences to the way you would normally tax your vehicle (e.g. car or motorcycle).

Follow these five simple steps to work out whether the change made to your vehicle will mean you need to pay more tax.

If the calculation shows the tax rate increased you would need to pay the higher rate from the first day of the month in which you change the tax rate.

An example:

Suppose you buy a car with disabled tax and you change car tax class from disabled to normal (e.g. private or PLG) on the 25th of March. Because you will remove disabled tax from a car you would have to pay the increased rate from the 1st of March (the start of that particular month).

If the calculation shows the tax rate decreased you would need to pay the lower rate from the first day of the following month.

An example:

Suppose you change car tax class to disabled classification on the 25th of March. If so, you would pay the decreased rate from the 1st of April (the next month).

Note: The short DVLA video [2:24 seconds] explains how to pay vehicle tax by Direct Debit online or at a Post Office branch that deals with vehicle tax.

Use the V70 form to change vehicle tax class providing the tax is not close to running out. But, you should use a different method if you already received a reminder letter or the ‘last chance’ warning letter (see below).

Fill in and send a V70 form ‘Application to change vehicle tax’ to the DVLA along with:

Important: Do not send the V70 form to the Post Office. You can only apply to change your vehicle’s tax class with the DVLA.

DVLA

Swansea

SA99 1BF

You can carry on using your car while the Driver and Vehicle Licensing Agency (DVLA) process changes in taxation classification.

Note: What if you do not have the V5C logbook? If not, you should use the DVLA form V62 ‘application for a vehicle registration certificate’ instead. Send the V62 tax class application with the £25 fee to DVLA Swansea SA99 1DD.

In some cases, you will have to change car tax class at one of the Post Office branches that deal with road tax. It will be necessary if:

Note: People with a disability may be eligible for a vehicle tax reduction. In this case, you would need to apply by post to the DVLA instead.

You can continue using your vehicle while the Driver and Vehicle Licensing Agency (DVLA) process the relevant changes in taxation class.

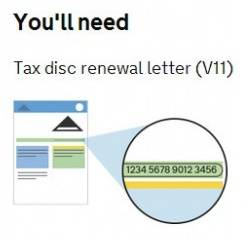

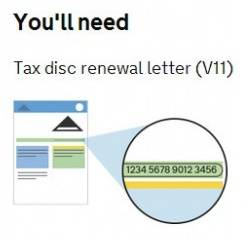

What if you are missing your DVLA V11 reminder letter or the V5C registration certificate? You can still pay for vehicle road tax at certain branches of the Post Office®.

The documentation that you would need to take, includes:

Note: You can also apply for tax class V62 registration certificate at the same visit. The V62 application form is available at any vehicle tax Post Office branch and the cost is £25.00.

To change the tax classification of a Lorry or a bus, besides the usual documentation, you will also need to produce:

Note: A different section has further information and guidance on how to manufacture or adapt a vehicle (e.g. getting vehicle approval).

If the road tax is due to run out, to change the taxation classification of a goods vehicle over 3500kg (e.g. a lorry or a bus) you will also need to send:

Note: You can also use the exemption from heavy goods vehicle (HGV) annual testing (form V112G) if the vehicle requires it.

DVLA Change Tax Class Online (V70 Form) or at Post Office (V62)Disclaimer: Information given does not constitute or replace legal advice. Always seek expert guidance from a law firm or professional for matters of importance. Please read the full terms and conditions for further details.